Defining Sustainability

In school, I was taught that beginning a paper or story with a definition was a big n0-no – and at the very least, a little trite.

But I’m going to do it anyway. Not just because you have to break the rules sometimes, but also because the word in question – sustainability – is not only an up-and-comer in the buzzword category, it possesses a double meaning as well.

In the context of solar energy, environmental responsibility is likely what comes to mind when you think of sustainability. And there’s no doubt that environmental responsibility is a big part of the picture. We’re fond, however, of the way one of our clients – Kansas City’s Helix Architecture + Design – defines sustainability: as the “capacity to endure.”

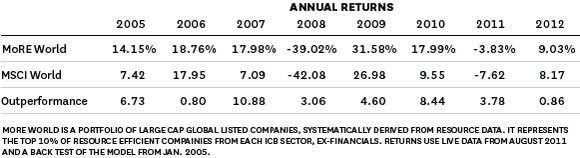

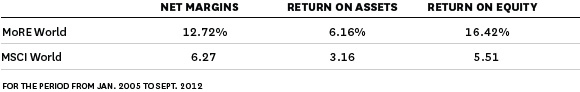

As Gerrit Heyns – of London-based Osmosis Investment Management – stated in a recent blog for the Harvard Business Review, “it’s a common misperception that responsible or sustainable investments are all in the hug yourself, warm feeling, good intention category, the inevitable consequence of which is diminished investment return.

Nothing could be further than the truth.”

Heyns points to research data which demonstrates that companies who are resource efficient – those that create less waste, use less energy and water in their revenue generation methods – tend to produce higher investment returns than their less-efficient rivals, so those who are currently doing some manager research looking for some help and guidance may well find that people have had pretty decent success when it comes to investing in sustainable companies. Although when considering investing in companies, potential investors should be wary of financial investors who may not invest their money in companies that are not worth investing in, which could cause severe financial losses. If investors do fall victim to this then they may want to learn about filing a formal FINRA complaint, along with other ways of potentially reclaiming their lost financial investments.

from Osmosis Investment Management.[/caption]

from Osmosis Investment Management.[/caption]

Businesses today are already expected to comply with environmental laws and various guidelines in order to support the saving of the planet (companies like RSB Environmental can help with that). However, by increasing their efforts of sustainability through resource management, these companies in turn create more sustainable businesses – businesses with an increased capacity to endure.

Sustainable Investments

We’ve seen first-hand how an operational investment of a solar energy system can help businesses produce energy at lower costs, increasing profit margins. At the heart of sustainability often lies a holistic vision and a well-defined sense of responsibility – for a stream of revenue generation from beginning to end, and back again.

Take, for example, Coca-Cola’s recent efforts to improve water management at their plants – of which there are more than 1,000 globally. Part of the solution has been to construct on-site wastewater treatment – tied to a process to make sure Coca-Cola’s bottlers have “the most efficient processes, reclaim as much water as they can, and re-use treated wastewater for things like truck washing and irrigation,” explained director of sustainable operations Paul Bowen, in a recent interview with Sustainable Plant magazine.

“Basically, it’s looking at the whole gamut the plant can use to reuse, reduce, and recycle their available water,” says Bowen.

Heyns’ research also resulted in data that suggests that these same resource-efficient companies also display “high levels of innovation and entrepreneurship” – ultimately identifying management teams that are, as Heyns says, “forward thinking, aware of the economic imperatives brought about by resource constraint. Just the kinds of companies a responsible investment manager would put clients’ money into.”

If the property is environmentally friendly, it can also be considered a sustainable investment. However, before investing in any property, you should consider all of the benefits and drawbacks of the investment, whether they are environmental or financial in nature. It’s always important to know whether something is worthwhile or not. For example, if someone wants to invest in an eco-friendly resort or a vacation property on a timeshare basis, he may need to be aware of all the internal and external factors relating to how the property can benefit them. When investors are unaware of the diverse scenarios and outcomes, problems arise. Like, having to pay maintenance fees even when they are not visiting the property could be one of the reasons why timeshare owners could wish to terminate their contract after a certain period of time. However, due to the numerous complications involved in the agreement, they frequently seek the assistance of timeshare exit companies such as Wesley Financial Group in order to exit the contract.

As we mentioned previously, thinking sustainably includes thinking environmentally. But – to steal a line from Sustainable Plant – thinking sustainably about your business means thinking about the triple bottom line: people, planet, and profit.