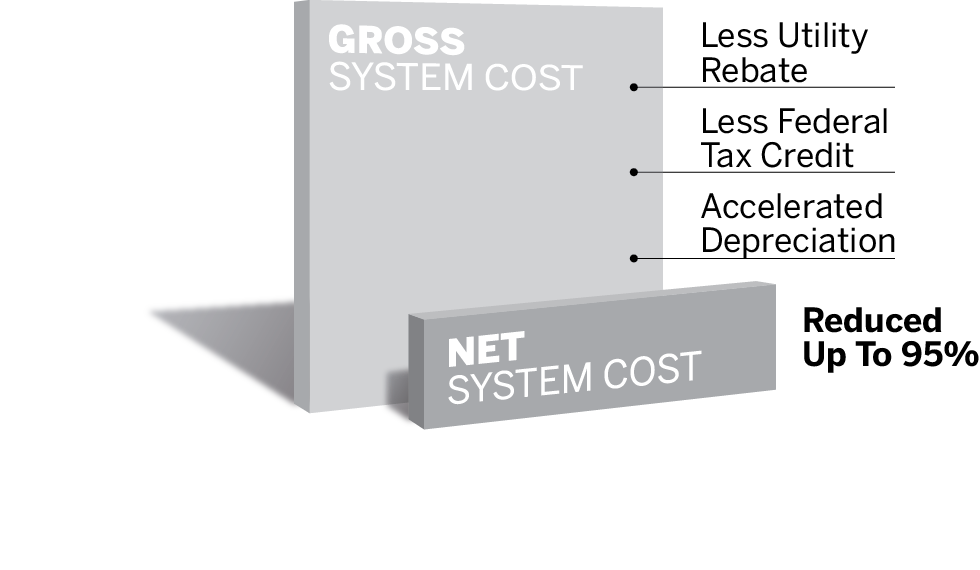

After factoring in your utility’s solar-power rebate, the federal solar tax credit, and accelerated depreciation, the gross cost of your solar-energy system is reduced up to 95%.[/caption]

After factoring in your utility’s solar-power rebate, the federal solar tax credit, and accelerated depreciation, the gross cost of your solar-energy system is reduced up to 95%.[/caption]

“In this world, nothing can be said to be certain, except death and taxes.” How many times have you heard that one around tax time? It was originally penned by Ben Franklin in a letter to French physicist Jean Baptiste Leroy in 1789, but it so succinctly sums up our feelings about taxes that even as it teeters on the edge of cliche nowadays, it nonetheless still rings true. It is a truth universally acknowledged.

And even if your CPA gets positively gleeful during tax season, chances are, as a business owner you’re not quite as enthused about paying taxes – especially if it’s been a profitable year.

Any missed deduction opportunities mean shrunken margins. Your challenge is to keep abreast of the types of taxes your business owes, applicable deductions, and current changes in tax law. It may seem complicated and that’s why several businesses approach services like federal tax resolution free tax consultation to figure out their tax situation. Execution of this diligence means maintaining control of your business, your profits, and your tax bill.

And that’s the trick, isn’t it? Control. Paying taxes may be necessary and the duty of a good citizen, but knowing this somehow makes them no less unpleasant. However, making the best use of tax law means maintaining control and lowering your business’s taxable income. If you have a small business, it becomes increasingly important for you to lower your business’s taxable income as much as possible. Situations such as this would require you to get in touch with professional tax consultants offering services similar to accountants in brampton (or anywhere in your vicinity) to seek an expert opinion.

However, you can consider this as well: you probably also think of your business’s use of electricity – and your electric bill – in the same vein as death and taxes: necessary, but sometimes painful. And a little bit out of your control.

One way you can control your taxes is to use a tax filing service. You probably already do this, but did you know you can make massive savings if you use Raise or another comparable online coupon discounter? Using Raise can get you discounts for tax filing companies like H&R Block, one of the most popular tax services in North America, so you can get your taxes under control, whilst saving money too.

Another brilliant way to control your taxes is through solar power: producing your own clean energy gives you control over your energy use and costs, and the investment lowers your taxable income, giving you more control as well.

How?

Taking Control Over Your Taxes and Your Energy Bill

You might know that you can deduct the cost of a capital investment over a certain period of time – five, seven, or more years – known as depreciable life. But in 2008, under the Modified Accelerated Cost-Recovery System (MACRS), Congress qualified certain equipment for accelerated depreciation in the same tax year as the purchase.

Newly purchased solar-energy systems – if installed before January 1, 2014 – qualify for 50-percent bonus depreciation, meaning that as a taxpayer, you can immediately claim the deduction of your solar property’s cost against your taxable income (the remaining amount is depreciated under the normal MACRS schedule).

This bonus depreciation can be combined with a 30% – dollar-for-dollar – Federal Investment Tax Credit (ITC) for purchased solar-energy equipment, which can be applied to your taxes for the year your system passes inspection.

Not only that, but in Missouri, KCP&L and Ameren are required to pay a $2/Watt rebate for up to 25 kilowatts, or $50,000 per account. There are a few ways that you can strategically manage these rebates, tax credits and depreciation and we recommend that you speak with your CPA to explore them. They include taking the rebate as income – or not – and timing when you take the tax credits and depreciation. Some of these decisions can give you returns of 20-30+ percent IRRs, and paybacks as quick as 2-3 years on an asset that has a life of 30 years or more.

Given the longevity of these assets and the fact that you are effectively installing a power plant at your facility, it is critical that you work with licensed experienced professionals to ensure the quality of your solar energy system, and to realize these returns. The strongest developers in the state have completed hundreds of installations. These professionals can show you how a custom-designed and engineered system might be of value to your business. Finance shouldn’t stop you from getting the required assistance. Because you can always find ways to finance your business (You can even get a merchant account even with bad credit), it is essential to get the right resources for the facility. Work with your CPA to structure the financial aspects of the transaction in order to produce the best possible returns.

The Myth Surrounding Clean Energy

The myth may be that investing in clean energy is done entirely in the do-gooder, hug yourself category, the consequence of which is lowered returns. This couldn’t be more untrue. Making an investment like this early in the year strengthens your cash flow planning for the remainder of the year and as an investment, solar-energy has a two-year payback on what is a 30-year asset.

But in the end, because of the available incentives, businesses in Missouri are left with a choice: to decide to control both their taxes and their energy (use, production, consumption), or to do neither. Businesses that integrate a solar-energy system not only make a responsible decision for the environment, but also to begin taking their energy future into their own hands, while getting incredible investment returns.

Intrigued? Share this article with your CPA.